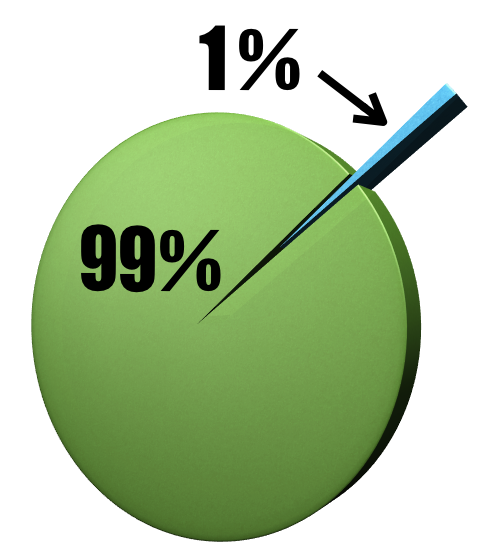

This post is part of the “Save 1% More” initiative started by Jim Blankenship, CFP at FinancialDucksInARow.com. We are encouraging Americans to start saving 1% more into their retirement plans.

I dare you to increase your retirement contributions by 1%.

Go ahead, I double-dog dare you!

For 20 years I have been hearing reports of how “pensions are rapidly becoming a thing of the past“. I don’t know what their definition of “rapidly” is, but everyone has been aptly warned by now!

It is no longer your employer’s job to make sure you save for retirement and the dismal failure that has become our Social Security system offers no promises of riches in our old age.

So what is the answer?

- Privatize a portion of Social Security contributions so we can actually save a legitimate sum of money?

- Pass a Federal law that makes people save?

- Transform our country into a socialistic society where the Government pays for everything (they would love that, wouldn’t they)?

The answer is to increase the amount you put into qualified retirement accounts by 1% a year. This is the perfect time to do it as many companies are offering open enrollment in their benefit plans right now.

A measly 1%?

You won’t miss it. It’s only a tenth of a tenth. If you make $50,000 a year then you would be increasing your contributions by $41.66 a month. That’s about $1.38 a day. Certainly you can do that!

Let’s play a guessing game

What will 3% of a $50,000 income saved in a retirement account averaging 10% from age 30 to age 65 turn into?

Answer: Over $425,000.

This example is completely unrealistic. Why? We didn’t adjust for future raises or company matches.

What that 1% can do for you

Increase your puny 3% contribution to 4% the 2nd year. Now we are at about $560,000, and all we had to do was start saving another 1% of our income.

Increase it by another 1% at age 32 and you will only be saving $2,500 (that’s less than $100 a paycheck) but would have $674,695 at full retirement.

You work too hard to retire broke

If all you do is save $100 a paycheck then you could realistically become a millionaire by the time you hit age 70.

Remember, our examples are based on a $50,000 income with no match and no raises. You work too hard to retire broke. Start saving for retirement today and push yourself to save 1% more than you would feel comfortable doing.

Your future self will thank you.

Love this post!! What a great “dare.” Very motivating. I will have to look into doing this myself.

-Derek C. Olsen

This advice sounds like it was written in the 1950s. Seriously? I have saved and saved and while I have a fair amount it is nowhere near enough to retire on. $550,000 (I am 52) and I may have to drag myself through 40 more years of this miserable life. I can’t get social security for another 15, yet even though I am told I look really young for my age (and I am not a fat overweight slob, I dye my hair, have no wrinkles because I have avoided the sun since I was 15….don’t eat garbage) I am convinced that if I lose the part time job I have, it will be my last job because employers (and yes even $#!T jobs) will not consider hiring anyone who is not 25 and a bubbly cheerleader type. I’m not a great BSing, asskissing Pollyanna either (which is different than being Toxic although most employers today do not know the difference).

And where do you get that these investments are going to earn 10% ??? I haven’t seen anything close to that since the 1970s.

My Salary is less than it was in the 80’s when I graduated college to become a telemarketer. My portfolio which began as a $150,000 investment in the mid-1990s is now only worth $450,000 20 years later. If we had not had the stock market crashes which were deliberately foisted on us by the 1% it might have been worth over $1 Million. As it is, a measly $10,000 per year doesn’t really cut it as I could have worked a part time job at Wal-Mart for that.

Anyway, since it is pretty clear that the government has no intention of cracking down on Hedge Funds or Derivatives, extreme crashes (the kind where half your savings is wiped out in a single afternoon) will be a regular occurrence.

I’m sorry to hear about your roller-coaster ride. There is no way to know what the market will do but your portfolio did triple in 20 years – and that’s surviving through the Dot-com bubble and Great Recession of 2008.

While I haven’t been investing as long as you have, I can testify that my investments have been doing well – and there’s nothing special about what we are doing. For example: I have an old 401k that I haven’t done anything with since 2006 and it’s doubled in value. It’s all in stock mutual funds.

I opened a ROTH IRA in 2008 that has more than tripled in value (which isn’t a surprise since it was opened at the bottom of the market)

And I opened another ROTH in 2013 with Betterment, which is all ETF stock funds, and so far it has made a 13.3% ROR.

I wouldn’t worry about the market. It corrects itself all the time – and makes buying mutual funds cheap when it goes down and the value go up when the market is bullish. But it does make me want to save more than I had last year – just in case my timing is off. 😉